Aluminum Extrusions from Fifteen Countries

U.S. launches antidumping & countervailing duty investigations

On October 4, 2023, U.S. Aluminum Extruders Coalition[1] and the United Steel, Paper and Forestry, Rubber, Manufacturing, Energy, Allied Industrial and Service Workers International Union (collectively, "Petitioners"), filed petitions with the U.S. International Trade Commission (ITC) and the U.S. Department of Commerce (DOC) seeking the imposition of antidumping duties on imports of certain aluminum extrusion products from the following fifteen countries:

China

Columbia

Dominican Republic

Ecuador

India

Indonesia

Italy

Malaysia

Mexico

South Korea

Taiwan

Thailand

Turkey

United Arab Emirates

Vietnam

Petitioners also called for countervailing duties on allegedly subsidized imports from China, Indonesia, Mexico, and Turkey.

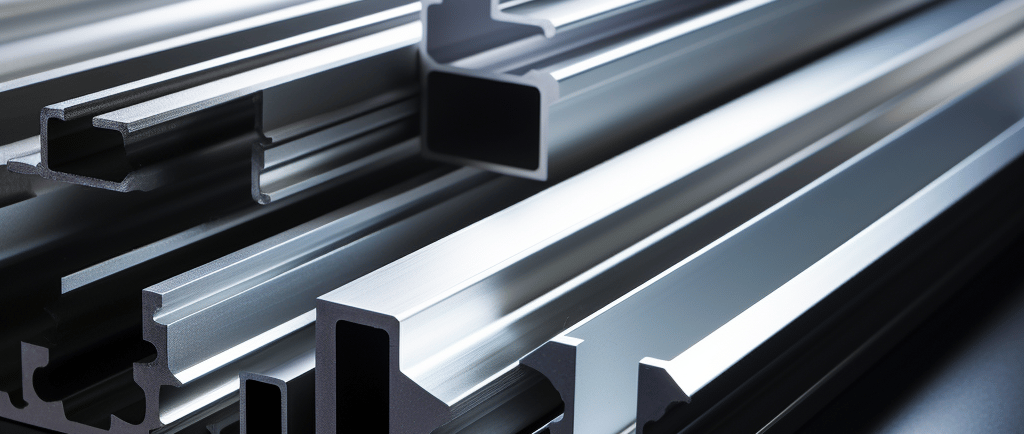

According to Petitioners, aluminum extrusions are primarily used in the following applications: building and construction, automotive, rail, aerospace, marine, solar module frames, structural fasteners for solar installations, air conditioners, appliances, furniture, lighting, sports equipment, electrical power units, food displays, refrigeration, medical equipment, display structures, and laboratory equipment.

The investigations’ requested scope overlaps with existing antidumping and countervailing duty orders on Chinese aluminum extrusions. Though the requested scope language explicitly eliminates this overlap, it is unclear whether what remains is substantial or if the Petitioners are addressing dissatisfaction with the scope language in the original case.

The Focus of the Investigations:

1. The DOC calculates the dumping margins or subsidy rates for foreign exporters of aluminum extrusions.

2. The ITC evaluates if U.S. aluminum extrusions producers are materially injured by the imports from these fifteen countries.

Dumping occurs when a foreign company sells a product in the United States at less than its normal value, as determined by the foreign company’s sales in its home market, sales in a comparison market, or below cost – essentially, this analysis is about price-discrimination. The price discrimination analysis yields a percentage called the margin of dumping. Petitioner alleges the following dumping margins for exporters of aluminum extrusions:

Given the numerous producers and exporters of aluminum extrusions, the DOC will likely examine only two companies from each country. The selection of these companies is normally based on export volume to the U.S. The selected companies will be required to participate fully in the investigation. And the dumping margins calculated for those companies usually serve as the basis for the duty rates for the other producers and exporters.

Subsidies are financial assistance from foreign governments that benefit the production, manufacture, or exportation of goods and are specific to the exporter or industry (countervailable subsidies). These subsidies may be in the form of discounted loans, tax breaks, direct grants, or low-cost rent, etcetera. Petitioner alleges that producers and exporters of aluminum extrusions from China, Indonesia, Mexico, and Turkey benefitted from numerous countervailable subsidies. DOC will examine those programs and calculate a separate countervailing duty (CVD) rate for the selected exporters and apply those rates to the non-selected exporters.

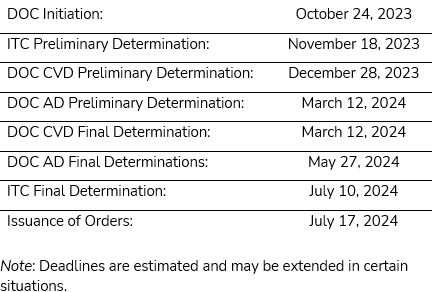

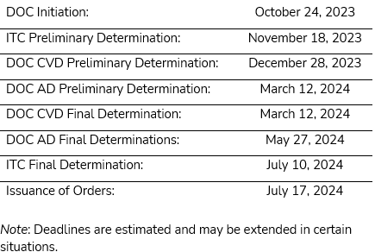

Injury investigation is usually initiated immediately after the petitions are filed. The ITC will have 45 days to reach a preliminary determination. Producers, importers, and exporters can participate in the injury investigation by submitting questionnaire responses about production, importation, and sales of aluminum extrusions. Questionnaires will be issued soon. Producers, importers, and exporters may also mount a defense at the ITC, challenging the allegation that imports are injuring the U.S. industry.

Key Dates:

Retroactive duties may be required for merchandise currently in transit or expected to be shipped soon. If Petitioner later alleges critical circumstances and dumping or subsidization are determined, imports arriving after October 4, 2023 (the date on which the petition was filed), but before the date of the AD and CVD preliminary determination dates, could be subject to retroactive cash deposits.

REQUESTED SCOPE OF MERCHANDISE UNDER CONSIDERATION

The merchandise subject to this investigation is aluminum extrusions, regardless of form, finishing, or fabrication, whether assembled with other parts or unassembled, whether coated, painted, anodized, or thermally improved. Aluminum extrusions are shapes and forms, produced by an extrusion process, made from aluminum alloys having metallic elements corresponding to the alloy series designations published by the Aluminum Association commencing with the numbers 1, 3, and 6 (or proprietary equivalents or other certifying body equivalents). Specifically, subject aluminum extrusions made from an aluminum alloy with an Aluminum Association series designation commencing with the number 1 contain not less than 99 percent aluminum by weight. Subject aluminum extrusions made from an aluminum alloy with an Aluminum Association series designation commencing with the number 3 contain manganese as the major alloying element, with manganese accounting for not more than 3.0 percent of total materials by weight. Subject aluminum extrusions made from an aluminum alloy with an Aluminum Association series designation commencing with the number 6 contain magnesium and silicon as the major alloying elements, with magnesium accounting for at least 0.1 percent but not more than 2.0 percent of total materials by weight, and silicon accounting for at least 0.1 percent but not more than 3.0 percent of total materials by weight. The scope also includes merchandise made from an aluminum alloy with an Aluminum Association series designation commencing with the number 5 (or proprietary equivalents or other certifying body equivalents) that have a magnesium content accounting for up to but not more than 2.0 percent of total materials by weight.

The country of origin of the aluminum extrusion is determined by where the metal is extruded (i.e., pressed through a die).

Aluminum extrusions are produced and imported in a wide variety of shapes and forms, including, but not limited to, hollow profiles, other solid profiles, pipes, tubes, bars, and rods. Aluminum extrusions that are drawn subsequent to extrusion (drawn aluminum) are also included in the scope.

Subject aluminum extrusions are produced and imported with a variety of coatings and surface treatments, and types of fabrication. The types of coatings and treatments applied to aluminum extrusions include, but are not limited to, extrusions that are mill finished (i.e., without any coating or further finishing), brushed, buffed, polished, anodized (including brightdip), liquid painted, electroplated, chromate converted, powder coated, sublimated, wrapped, and/or bead blasted. Subject aluminum extrusions may also be fabricated, i.e., prepared for assembly, or thermally improved. Such operations would include, but are not limited to, extrusions that are cut-to-length, machined, drilled, punched, notched, bent, stretched, stretch-formed, hydroformed, knurled, swedged, mitered, chamfered, threaded, and spun. Performing such operations in third countries does not otherwise remove the merchandise from the scope of the investigation.

The types of products that meet the definition of subject merchandise include but are not limited to, vehicle roof rails and sun/moon roof framing, solar panel racking rails and framing, tradeshow display fixtures and framing, parts for tents or clear span structures, fence posts, drapery rails or rods, electrical conduits, door thresholds, flooring trim, electric vehicle battery trays, heat sinks, signage or advertising poles, picture frames, telescoping poles, or cleaning system components. Heat sinks are included in the scope, regardless of whether the design and production of the heat sinks are organized around meeting specified thermal performance requirements and regardless of whether they have been tested to comply with such requirements.

Merchandise that is comprised solely of aluminum extrusions or aluminum extrusions and fasteners, whether assembled at the time of importation or unassembled, is covered by the scope in its entirety.

The scope also covers aluminum extrusions that are imported with non-extruded aluminum components beyond fasteners, whether assembled at the time of importation or unassembled, that are designed to be a part or subassembly of a larger product or system. Only the aluminum extrusion portion of the merchandise described in this paragraph, whether assembled or unassembled, is subject to duties. Examples of merchandise that is designed to be a part or subassembly of a larger product or system include, but are not limited to, window parts or subassemblies; door unit parts or subassemblies; shower and bath system parts or subassemblies; solar panel mounting systems; fenestration system parts or subassemblies, such as curtain wall and window wall units and parts or subassemblies of storefronts; furniture parts or subassemblies; appliance parts or subassemblies, such as fin evaporator coils and systems for refrigerators; railing or deck system parts or subassemblies; fence system parts or subassemblies; motor vehicle parts or subassemblies, such as bumpers for motor vehicles; trailer parts or subassemblies, such as side walls, flooring, and roofings; electric vehicle charging station parts or subassemblies; or signage or advertising system parts or subassemblies.

The scope excludes assembled merchandise containing non-extruded aluminum components beyond fasteners that is not a part or subassembly of a larger product or system and that is used as imported, without undergoing after importation any processing, fabrication, finishing, or assembly or the addition of parts or material, regardless of whether the additional parts or material are interchangeable. Examples of such excluded assembled merchandise include windows with glass, door units with door panel and glass, motor vehicles, trailers, furniture, appliances, and solar panels.

The scope also includes aluminum extrusions that have been further processed in a third country, including, but not limited to, the finishing and fabrication processes described above, assembly, whether with other aluminum extrusion components or with non-aluminum extrusion components, or any other processing that would not otherwise remove the merchandise from the scope if performed in the country of manufacture of the in-scope product. Third-country processing; finishing; and/or fabrication, including those processes described in the scope, does not alter the country of origin of the subject aluminum extrusions.

The following aluminum extrusion products are excluded: aluminum extrusions made from an aluminum alloy with an Aluminum Association series designations commencing with the number 2 (or proprietary equivalents or other certifying body equivalents) and containing in excess of 1.5 percent copper by weight; aluminum extrusions made from an aluminum alloy with an Aluminum Association series designation commencing with the number 5 (or proprietary equivalents or other certifying body equivalents) and containing in excess of 2.0 percent magnesium by weight; and aluminum extrusions made from an aluminum alloy with an Aluminum Association series designation commencing with the number 7 (or proprietary equivalents or other certifying body equivalents) and containing in excess of 2.0 percent zinc by weight.

The scope also excludes aluminum alloy sheet or plates produced by means other than the extrusion process, such as aluminum products produced by a method of continuous casting or rolling. Cast aluminum products are also excluded. The scope also excludes unwrought aluminum in any form.

The scope also excludes collapsible tubular containers composed of metallic elements corresponding to alloy code 1080A as designated by the Aluminum Association where the tubular container (excluding the nozzle) meets each of the following dimensional characteristics: (1) length of 37 millimeters ("mm") or 62 mm, (2) outer diameter of 11.0 mm or 12.7 mm, and (3) wall thickness not exceeding 0.13 mm.

Also excluded from the scope of these investigations is certain rectangular wire, imported in bulk rolls or precut strips and produced from continuously cast rolled aluminum wire rod, which is subsequently extruded to dimension to form rectangular wire with or without rounded edges. The product is made from aluminum alloy grade 1070 or 1370, with no recycled metal content allowed. The dimensions of the wire are 2.95 mm to 6.05 mm in width, and 0.65 mm to 1.25 mm in thickness. Imports of rectangular wire are provided for under HTSUS categories 7605.19.0000, 7604.29.1090, or 7616.99.5190.

Also excluded from the scope of these investigations are all products covered by the scope of the antidumping and countervailing duty orders on Aluminum Extrusions from the People’s Republic of China. See Aluminum Extrusions from the People’s Republic of China: Antidumping Duty Order, 76 FR 30,650 (May 26, 2011); Aluminum Extrusions from the People’s Republic of China: Countervailing Duty Order, 76 FR 30,653 (May 26, 2011).

Imports of the subject merchandise are primarily provided for under the following categories of the Harmonized Tariff Schedule of the United States (HTSUS): 7604.10.1000; 7604.10.3000; 7604.10.5000; 7604.21.0010; 7604.21.0090; 7604.29.1010; 7604.29.1090; 7604.29.3060; 7604.29.3090; 7604.29.5050; 7604.29.5090; 7608.10.0030; 7608.10.0090; 7608.20.0030; 7608.20.0090; 7609.00.0000; 7610.10.0010; 7610.10.0020; 7610.10.0030; 7610.90.0040; and 7610.90.0080.

Imports of the subject merchandise, including subject merchandise entered as parts of other products, may also be classifiable under the following additional HTSUS categories, as well as other HTSUS categories: 6603.90.8100; 7606.12.3091; 7606.12.3096; 7615.10.2015; 7615.10.2025; 7615.10.3015; 7615.10.3025; 7615.10.5020; 7615.10.5040; 7615.10.7125; 7615.10.7130; 7615.10.7155; 7615.10.7180; 7615.10.9100; 7615.20.0000; 7616.10.9090; 7616.99.1000; 7616.99.5130; 7616.99.5140; 7616.99.5190; 8302.10.3000; 8302.10.6030; 8302.10.6060; 8302.10.6090; 8302.20.0000; 8302.30.3010; 8302.30.3060; 8302.41.3000; 8302.41.6015; 8302.41.6045; 8302.41.6050; 8302.41.6080; 8302.42.3010; 8302.42.3015; 8302.42.3065; 8302.49.6035; 8302.49.6045; 8302.49.6055; 8302.49.6085; 8302.50.0000; 8302.60.9000; 8305.10.0050; 8306.30.0000; 8414.59.6590; 8415.90.8045; 8418.99.8005; 8418.99.8050; 8418.99.8060; 8419.50.5000; 8419.90.1000; 8422.90.0640; 8424.90.9080; 8473.30.2000; 8473.30.5100; 8479.89.9599; 8479.90.8500; 8479.90.9596; 8481.90.9060; 8481.90.9085; 8486.90.0000; 8487.90.0080; 8503.00.9520; 8508.70.0000; 8513.90.2000; 8515.90.2000; 8516.90.5000; 8516.90.8050; 8517.71.0000; 8517.79.0000; 8529.90.7300; 8529.90.9760; 8536.90.8585; 8538.10.0000; 8541.90.0000; 8543.90.8885; 8708.10.3050; 8708.29.5160; 8708.80.6590; 8708.99.6890; 8807.30.0060; 9013.90.7000; 8708.29.5160; 8708.80.6590; 8708.99.6890; 8807.30.0060; 9013.90.7000; 9013.90.8000; 9031.90.9195; 9401.99.9081; 9403.10.0040; 9403.20.0086; 9403.91.0005; 9403.91.0010; 9403.91.0080; 9403.99.1040; 9403.99.1050; 9403.99.1085; 9403.99.2040; 9403.99.2080; 9403.99.3005; 9403.99.3010; 9403.99.3080; 9403.99.4004; 9403.99.4010; 9403.99.4080; 9403.99.5005; 9403.99.5010; 9403.99.5080; 9403.99.9010; 9403.99.9015; 9403.99.9020; 9403.99.9040; 9403.99.9045; 9403.99.9051; 9403.99.9061; 9405.99.4020; 9506.11.4080; 9506.51.4000; 9506.51.6000; 9506.59.4040; 9506.70.2090; 9506.91.0010; 9506.91.0020; 9506.91.0030; 9506.99.0510; 9506.99.0520; 9506.99.0530; 9506.99.1500; 9506.99.2000; 9506.99.2580; 9506.99.2800; 9506.99.5500; 9506.99.6080; 9507.30.2000; 9507.30.4000; 9507.30.6000; 9507.30.8000; 9507.90.6000; and 9603.90.8050.

While HTSUS subheadings are provided for convenience and customs purposes, the written description of the scope is dispositive.

[1] The Coalition consists of the following companies: Alexandria Extrusion Company; APEL Extrusions; Bonnell Aluminum; Brazeway; Custom Aluminum Products; Extrudex Aluminum; International Extrusions; Jordan Aluminum Company; M-D Building Products, Inc.; Merit Aluminum Corporation; MI Metals; Pennex Aluminum; Tower Extrusions; and Western Extrusions.